XAU/USD Shows Mild Upward Trend Amid Economic Uncertainty

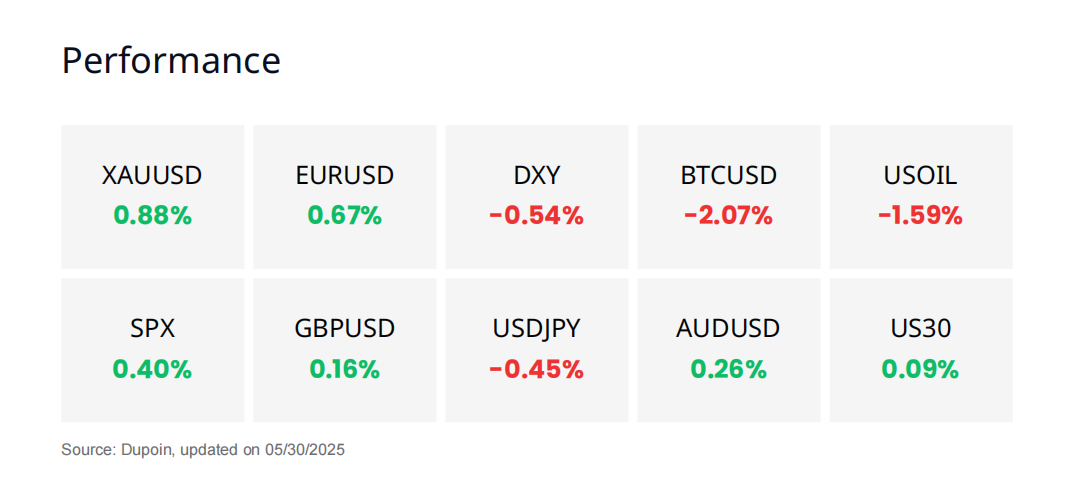

Market Overview

Australia

Australia’s labor market is currently in a “just right” state — not too hot to fuel inflation, but not too weak to trigger unemployment. According to Goldman Sachs, the 4.1% unemployment rate is close to the equilibrium level of 4.25%, indicating that wage pressure has cooled. Job-switching and job-finding rates have also declined, reinforcing the view that the market is stabilizing.

However, business investment in Q1 fell by 0.1%, contrary to expectations of a 0.5% increase, reflecting cautious sentiment amid global uncertainties and domestic policy concerns. The AUD is under downward pressure as the USD strengthens following a U.S. court

United Kingdom

The British pound is trading around $1.348, easing slightly after reaching a three-year high of $1.356. Bullish momentum has cooled as investors reassess global growth prospects and react to a U.S. court decision overturning a range of Trump-era tariffs, which has added uncertainty to UK–U.S. trade negotiations.

Domestically, the UK government has proposed requiring pension funds to increase investments in private projects and domestic infrastructure, aiming to mobilize £27.5 billion. However, the plan has faced concerns from asset managers who worry it may compromise clients' interests. ruling on tariffs.

Gold Spot (XAUUSD)

Fundamental Analysis

Gold prices edged up to $3,317/oz, ending a two-day losing streak amid uncertainty following a U.S. court decision to revoke most of Trump-era tariffs. Although the ruling was welcomed by investors, the potential for a Trump administration appeal has kept defensive sentiment toward gold intact.

Additionally, weakening U.S. economic data continues to support gold prices. Q1 GDP contracted by 0.2%, and jobless claims rose sharply, reinforcing expectations that the Fed may cut interest rates soon. The U.S. dollar and Treasury yields also retreated accordingly.

Technical Analysis

XAU/USD is showing a mild upward sideways trend, with prices fluctuating between $3,311 and $3,322.The price rebounded from a strong support zone (supply area around $3,120–$3,160) but has yet to break through the key resistance at the April 23, 2025 gap zone ($3,360–$3,380).

Volume has been declining during the sideways movement, suggesting indecision between buyers and sellers. However, higher volume near recent support levels indicates buying pressure still exists.

Dollar - yen (USDJPY)

Fundamental Analysis

BoJ Governor Ueda noted that Japanese firms continue to raise prices and wages, even though the central bank has revised down its inflation forecast due to falling oil prices and easing global pressures. However, new data shows Tokyo's May CPI rose by 3.4% y/y—above

expectations—raising market doubts about the BoJ's ability to maintain a dovish stance.

The yen strengthened to 143.80/USD, while Japanese equities dropped sharply by 1.6% amid concerns over potential BoJ tightening and ongoing U.S. trade uncertainties. Tech stocks led the sell-off, with Renesas down 4.7% and SoftBank sliding 4.1%.ccordingly.

Technical Analysis

Recent trend: A strong downtrend within a bearish channel from the peak around 148.65 to 142.35.Breakout & current move: Price broke out of the bearish channel and surged past the 145.5 resistance, but was rejected near the 146.7 resistance and is now pulling back.

Volume: The breakout rally was supported by a volume spike, confirming genuine buying interest. However, the correction that followed showed high volume as well, indicating strong profit-taking pressure.

Bitcoin (BTCUSD)

Fundamental Analysis

Bitcoin has continued to decline toward the $104,600 area before staging a mild recovery, as the market hesitates near the strong resistance zone of $107,500. Analyst Dr. Cat warned that expecting a deep correction is “an illusion,” citing Ichimoku data that suggests BTC remains in a long-term uptrend as long as it holds above $103,600 this week.

On a positive note, Paris Saint-Germain announced plans to hold Bitcoin in its club treasury, while Amboss launched a self-custody yield product on the Lightning Network. These developments underscore Bitcoin’s expanding ecosystem despite the current price pullback.

Technical Analysis

Trend: Currently in a correction phase after failing to sustain the resistance zone around $109,000–$112,000.

Short-term bias: Bearish, as price has formed lower highs and broken below dynamic support levels.

Volume: Selling volume has increased slightly in recent sessions, confirming downside pressure. However, the latest rebound candle shows a long lower wick and higher volume — a possible sign of demand absorption near the $105,000 area.

Disclaimer

Derivative investments involve significant risks that may result in the loss of your invested capital. You are advised to carefully read and study the legality of the company, products, and trading rules before deciding to invest your money. Be responsible and accountable in your trading.

RISK WARNING IN TRADING

Transactions via margin involve leverage mechanisms, have high risks, and may not be suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be cautious of those who promise profits in trading. It's recommended not to use funds if you're not ready to incur losses. Before deciding to trade, make sure you understand the risks involved and also consider your experience.