Market Analysis

GBPUSD

Forecast: Anticipated Upturn

Fundamental Analysis:

The GBP/USD pair is currently recovering from recent losses, trading around 1.2840 during the Asian session. A review of the daily chart indicates that the pair might be in a consolidation phase or potentially reversing within a descending channel. After climbing above 1.2850 on Tuesday, the pair lost momentum and ended the day lower. It remains stagnant just below 1.2850 as investors await the upcoming monetary policy decisions from the Federal Reserve and the Bank of England.

The US Dollar has shown resilience, bolstered by stronger-than-expected consumer confidence and job openings data, which strengthens the currency's position against other currencies.

Technical Analysis:

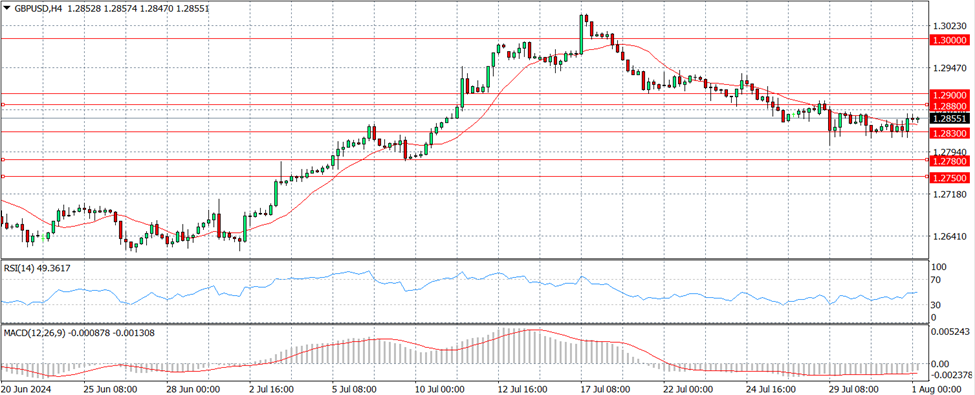

The GBP/USD pair continues to trade below a descending trend line established in mid-July. The Relative Strength Index (RSI) on the 4-hour chart remains below 40, signaling a bearish outlook.

On the downside, immediate support is found at 1.2830, corresponding to the 50% Fibonacci retracement of the recent uptrend. If this support level becomes resistance, further declines could occur towards 1.2800 (200-period SMA and psychological level), 1.2780 (61.8% Fibonacci retracement), and 1.2750 (static level).

Conversely, if the pair breaks above the descending trend line near 1.2840, it may encounter resistance at 1.2880 (38.2% Fibonacci retracement) before testing 1.2900 (100-period SMA).

Disclaimer

Derivative investments involve significant risks and may result in the loss of the capital you invest. You are advised to carefully read and study the legality of the company, products, and trading rules before deciding to invest your money. Be responsible and accountable in your trading.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.