Market Analysis

XAUUSD

Forecast: Uptrend Expected

Fundamental Overview:

Gold prices surged on Wednesday following the Federal Reserve's indication that it might cut borrowing costs as early as September. This shift, coupled with a decline in US Treasury yields and a weaker US dollar—reaching its lowest point since July 18—has heightened the attractiveness of gold, a non-yielding asset. Additionally, the escalating geopolitical tensions in the Middle East, particularly between Israel and Iran, have driven investors toward gold as a safe-haven asset. The weakening dollar and lower yields have further supported gold’s upward movement.

Technical Analysis:

Gold is currently trading within a modestly ascending channel on the daily chart, though it has been largely consolidating for over three months. The 50-day Exponential Moving Average (EMA) at around $2,366 remains a key support level for gold bulls. The 14-day EMA oscillates between 40.00 and 60.00, reflecting market indecision. A breakout above the record high of $2,483.75 would signal a potential for new gains. Conversely, support is anticipated near the upward-sloping trendline around $2,225, traced from the October 6 low near $1,810.50. Overall, the technical outlook suggests that gold may continue to consolidate in the near term.

EURUSD

Prediction: Upsurge Expected

Fundamental Analysis:

The EUR/USD pair hovered around critical technical levels on Wednesday following the Federal Reserve's decision to keep interest rates unchanged, aligning with market expectations. The US dollar experienced renewed selling pressure after a hawkish statement from the Bank of Japan and hints that the Fed might initiate rate cuts as early as September.

The dollar's negative outlook persisted as the Fed acknowledged that inflation remains "somewhat" high and reiterated its stance of not lowering rates until there is greater assurance that inflation is moving towards the 2% target. Nonetheless, the policy divergence between the Fed and the European Central Bank (ECB) is likely to continue, with both central banks anticipated to lower rates in the near future.

Despite stronger-than-expected inflation data from the Eurozone, the ECB's plans to cut rates in September are unlikely to be affected.

Technical Analysis:

On the downside, significant support levels for EUR/USD include the weekly low of 1.0798, the 100-day SMA at 1.0793, and the June low of 1.0666, with the May low of 1.0649 as the next potential support.

On the upside, initial resistance is found at the July high of 1.0948, followed by the March peak of 1.0981 and the psychological level of 1.1000. The broader bearish trend could reassert itself if the pair remains below the critical 200-day SMA at 1.0822.

In the short term, the pair is consolidating, with the 55-SMA at 1.0853 presenting a temporary obstacle. Resistance levels to watch are 1.0948, 1.0981, and 1.1000, while initial support is at 1.0798, followed by 1.0709.

USDJPY

Forecast: Decline Expected

Fundamental Analysis:

The USD/JPY pair has dipped below 149.00 during the Asian session, reaching a four-month low around 148.50. This drop highlights the continued divergence between the Federal Reserve and the Bank of Japan (BoJ), coupled with rising geopolitical tensions in the Middle East. The Japanese Yen has gained strength for the past three weeks, bolstered by its safe-haven status amid global economic uncertainties. Looking ahead, attention will shift to the upcoming BoJ meeting, where a 10 basis point rate hike and a reduction in bond-buying operations are anticipated. Conversely, the US Dollar has seen a minor rebound, momentarily halting the pair's decline as investors await the Fed's decision.

The Fed is expected to keep rates steady but may signal a dovish outlook in its upcoming meeting.

Technical Analysis:

The anticipated rate hike by the BoJ could further bolster the Japanese Yen, potentially weighing on the USD/JPY pair. Meanwhile, the Fed's expected decision to maintain current rates, combined with potential guidance on future monetary policy, will be crucial for market direction. Traders are currently adopting a wait-and-see approach, holding off on significant moves in the USD/JPY pair until the outcomes of these pivotal central bank meetings are revealed.

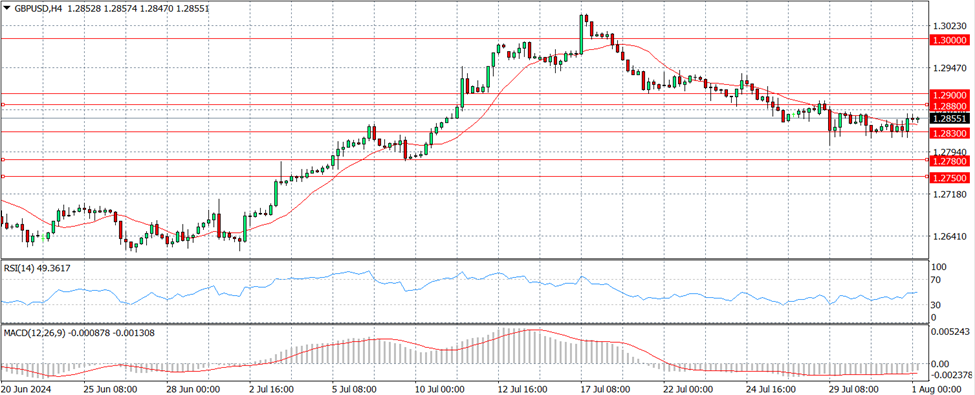

GBPUSD

Forecast: Anticipated Upturn

Fundamental Analysis:

The GBP/USD pair is currently recovering from recent losses, trading around 1.2840 during the Asian session. A review of the daily chart indicates that the pair might be in a consolidation phase or potentially reversing within a descending channel. After climbing above 1.2850 on Tuesday, the pair lost momentum and ended the day lower. It remains stagnant just below 1.2850 as investors await the upcoming monetary policy decisions from the Federal Reserve and the Bank of England.

The US Dollar has shown resilience, bolstered by stronger-than-expected consumer confidence and job openings data, which strengthens the currency's position against other currencies.

Technical Analysis:

The GBP/USD pair continues to trade below a descending trend line established in mid-July. The Relative Strength Index (RSI) on the 4-hour chart remains below 40, signaling a bearish outlook.

On the downside, immediate support is found at 1.2830, corresponding to the 50% Fibonacci retracement of the recent uptrend. If this support level becomes resistance, further declines could occur towards 1.2800 (200-period SMA and psychological level), 1.2780 (61.8% Fibonacci retracement), and 1.2750 (static level).

Conversely, if the pair breaks above the descending trend line near 1.2840, it may encounter resistance at 1.2880 (38.2% Fibonacci retracement) before testing 1.2900 (100-period SMA).

Disclaimer

Derivative investments involve significant risks and may result in the loss of the capital you invest. You are advised to carefully read and study the legality of the company, products, and trading rules before deciding to invest your money. Be responsible and accountable in your trading.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.